After months of uncertainty over the future level of Australia’s Renewable Energy Target (RET), the federal government and opposition have reached a compromise agreement to scale back the target.

The deal will see the RET wound back to 33,000 gigawatt hours of renewable energy by 2020, down from its previous level of 41,000 GWh. The government had earlier sought a target of around 27,000 GWh, but the new compromise was reached after the Labor opposition and the renewables industry each indicated they would be willing to agree on a level in the low-30,000s to end the stalemate.

An end to uncertainty, yes, but what will the new target mean for the future of Australia’s renewable energy industry?

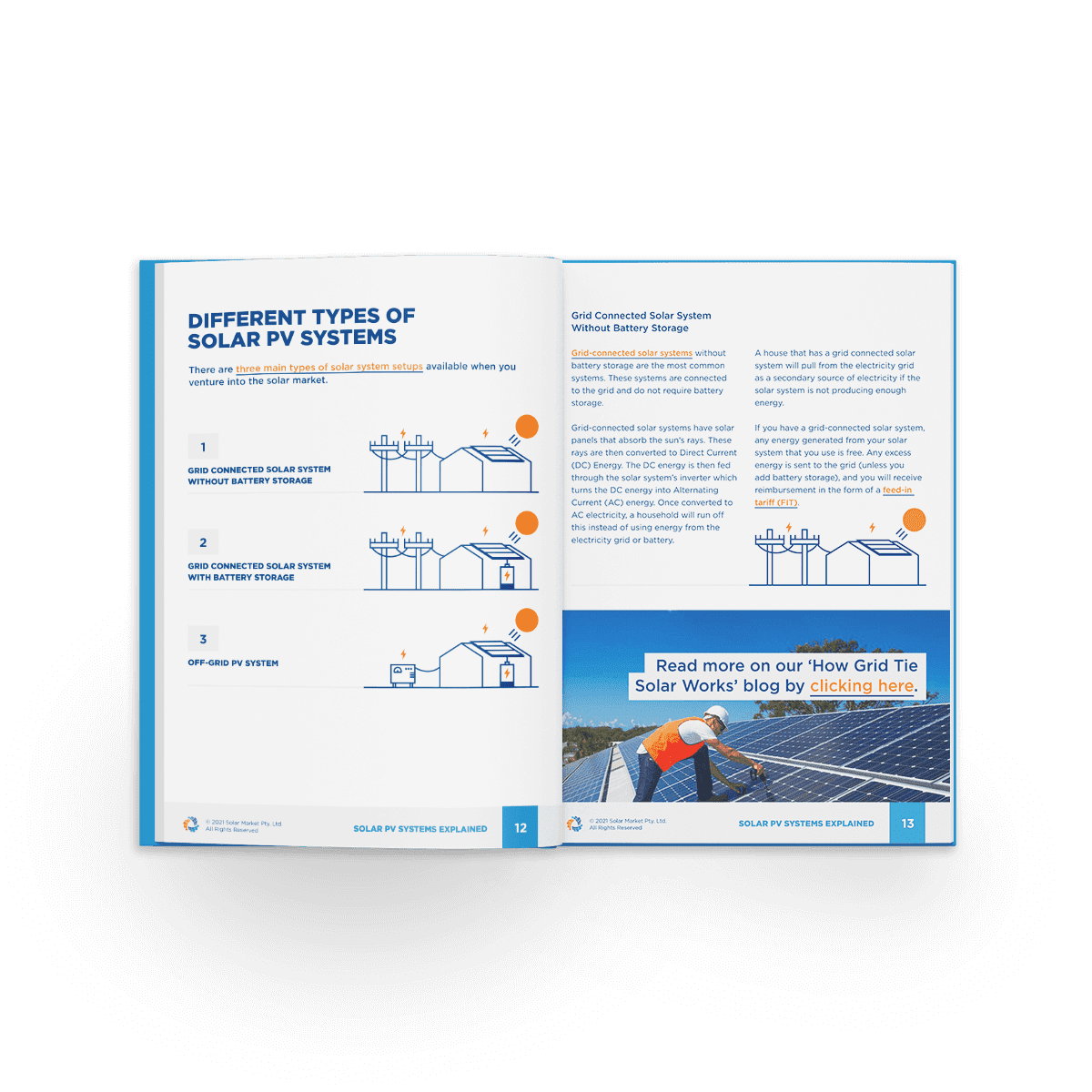

Fossil fuels still dominant

The Energy Supply Association of Australia, in its Electricity Gas Australia 2014 report, indicates that 88% of power generation (192,205 GWh of the 218,000 GWh total) still comes from fossil fuels. Most of the rest comes from hydro power, most of which falls outside the RET scheme. Solar, wind and biofuels only account for about 8,000 GWh.

Australia’s energy-generation mix. ESAA (2014), Author provided

This means that to meet the newly mandated 33,000 GWh in 2020, the renewable energy sector will have to more than quadruple in size from its current level of output. Encouraging investment will be crucial.

The government’s rationale for the cut is that, given future projections, 41,000 GWh will end up being far more than the 20% of total energy output that the scheme was intended to deliver. But future energy projections are inherently uncertain, being dependent on economic growth and a host of other factors.

What we can say, based on the most recent (2012-13) annual power generation figure of 218,000 GWh, is that if this level of demand is the same in 2020, then 20% of that would be 43,600 GWh of renewables. This is more than the current 41,000 GWh provided in the legislation, so why reduce the target and widen the gap even more?

Cutting back the RET risks future investment, because many companies looking at investing in projects that would help deliver this 20% are now likely to think twice, given that the reduced target means there is now much less subsidy on offer. It’s just as likely that future economic growth through to 2020 would require more electricity, not less – unless the government is planning to leave the economy in neutral, which is hardly likely given what its Energy White Paper has to say about growing resource exports.

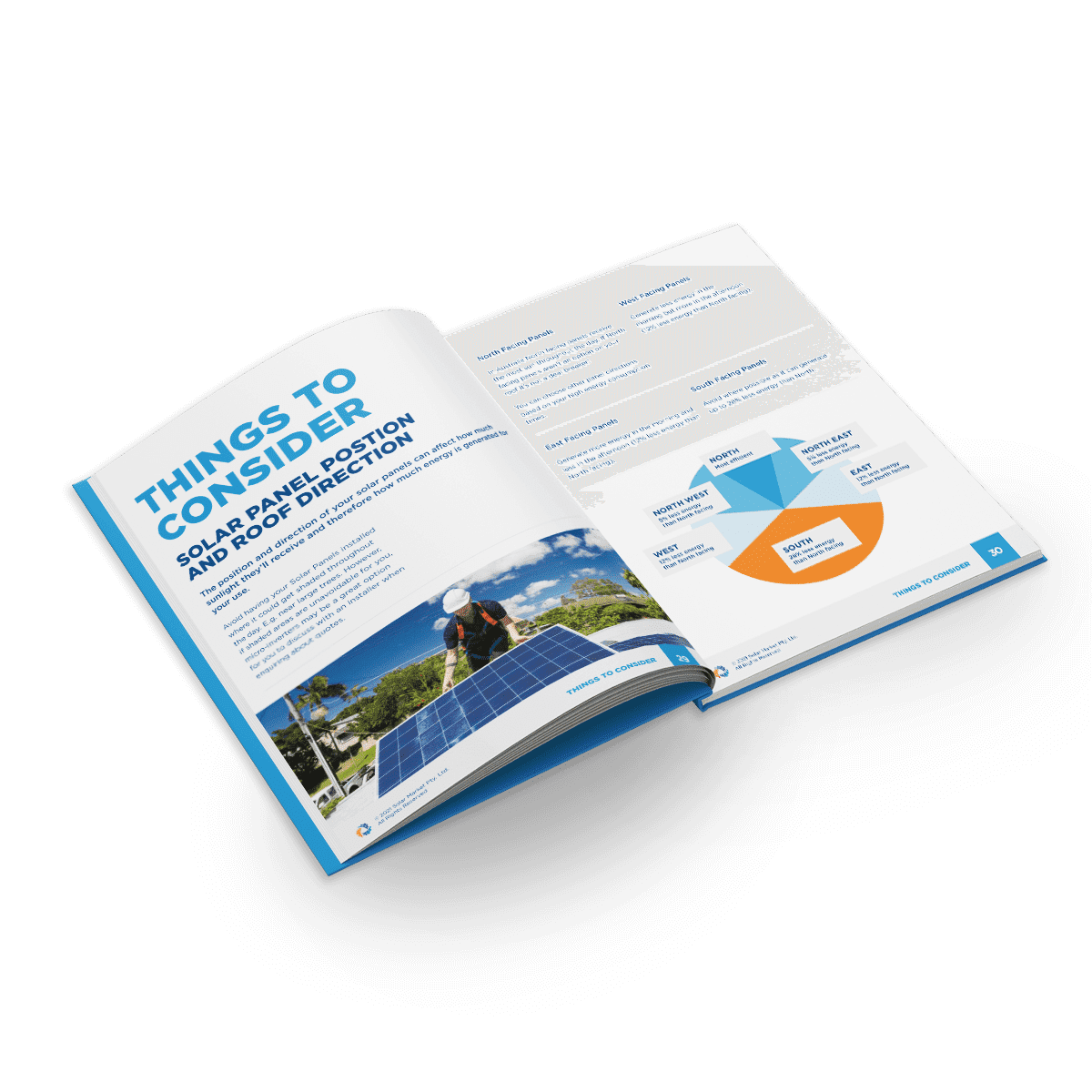

The investment pipeline

Besides the renewable energy facilities that are already up and running, there is currently a further 1,540 megawatts of committed renewable energy projects (1,287 MW of wind and the rest solar) in the pipeline, according to a report from the Bureau of Resource and Energy Economics. (The intermittency of many renewable energy sources makes it difficult to say exactly how many GWh of power this new capacity will deliver.)

While Australia has been a leader in innovative renewable energy research in fields such as geothermal and wave systems, there is currently nothing committed in these two areas.

Hydro and wind are the most established renewable sources, but there is little more in the pipeline. BREE (2014), Author provided

If we extend this to include renewable energy projects that are currently going through the feasibility stage, then the amount of renewable energy projects under consideration increases by an extra 14,048 MW of capacity.

But to put this into context, there is also an extra 13,094 MW of non-renewable generation – and given that the government’s Energy White Paper states that 75% of existing coal-fired power plants have already passed their expected useful life (and promises a “technology-neutral” approach to future generation capacity), one would expect to see even more coal and gas plants being developed before renewable projects, to ensure that baseload power needs are met.

As the Energy White Paper shows, the government is intent on ensuring that no favours are handed to the renewable energy sector. Instead, its focus is on how to progress exploration in the coal and gas sectors and increase revenues from exports, rather than delivering future energy security by diversifying into renewable energy.

The problem with investing in renewables

One of the constant problems with renewable energy projects is the up-front cost of development.

For the projects noted above that are at the feasibility stage, the total cost of the renewable projects is A$21.8 billion, compared with only A$9.1 billion for the fossil fuel projects with almost the same power-generating capacity.

But this comparison fails to take into account the cost of fuel over the life of the fossil fuel projects. While renewable projects may have higher up-front costs, they also deliver considerable long-term benefits. Initiatives such as the Clean Energy Finance Corporation (CEFC) recognise this, but as stated in the Energy White Paper, the government is keen to push ahead with plans to abolish it.

This, along with the planned abolition of the Australian Renewable Energy Agency (ARENA), will prolong the uncertainty for the renewables industry, even after the end of the guessing-game over the level of the RET.

This means we are likely to see further stagnation in investment in renewable energy projects. Many of the recently completed generation projects were approved several years ago, and while newer projects can still be expected to enter the planning phase, many will not move out of the feasibility stage.

While the RET will be retained in its reduced form, without the support of the CEFC and ARENA the ability to help industry to move projects from concept to deployment will be significantly diminished.

This means that renewable energy in Australia will be based solely on using mature and proven technologies (such as solar and wind), at the expense of less established prospects such as geothermal or wave energy. The innovation that Australia has been known for internationally within this sector would become a distant memory.